Accumulated depreciation formula in excel

During each period of an assets lifetime the straight line technique simply subtracts. The calculated depreciation is based on initial asset cost salvage.

Depreciation Schedule Formula And Calculator

Calculate Accumulated Depreciation by Given Information Cost of the Machinery.

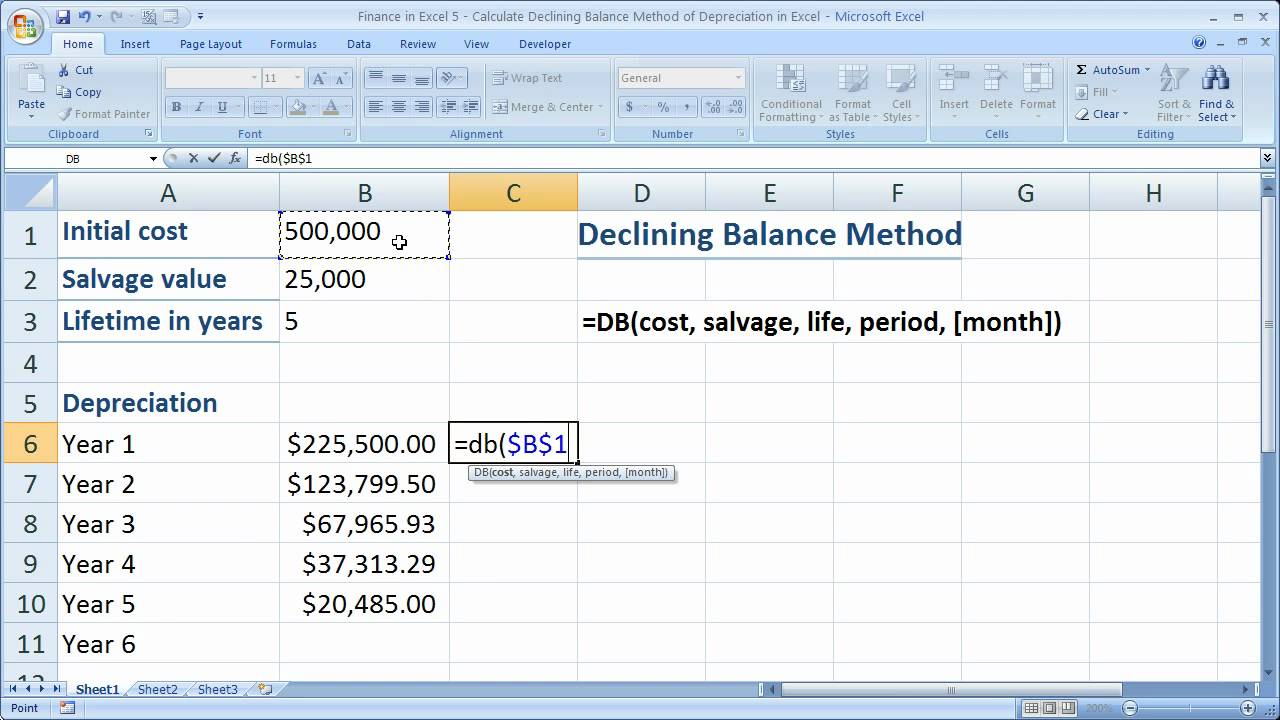

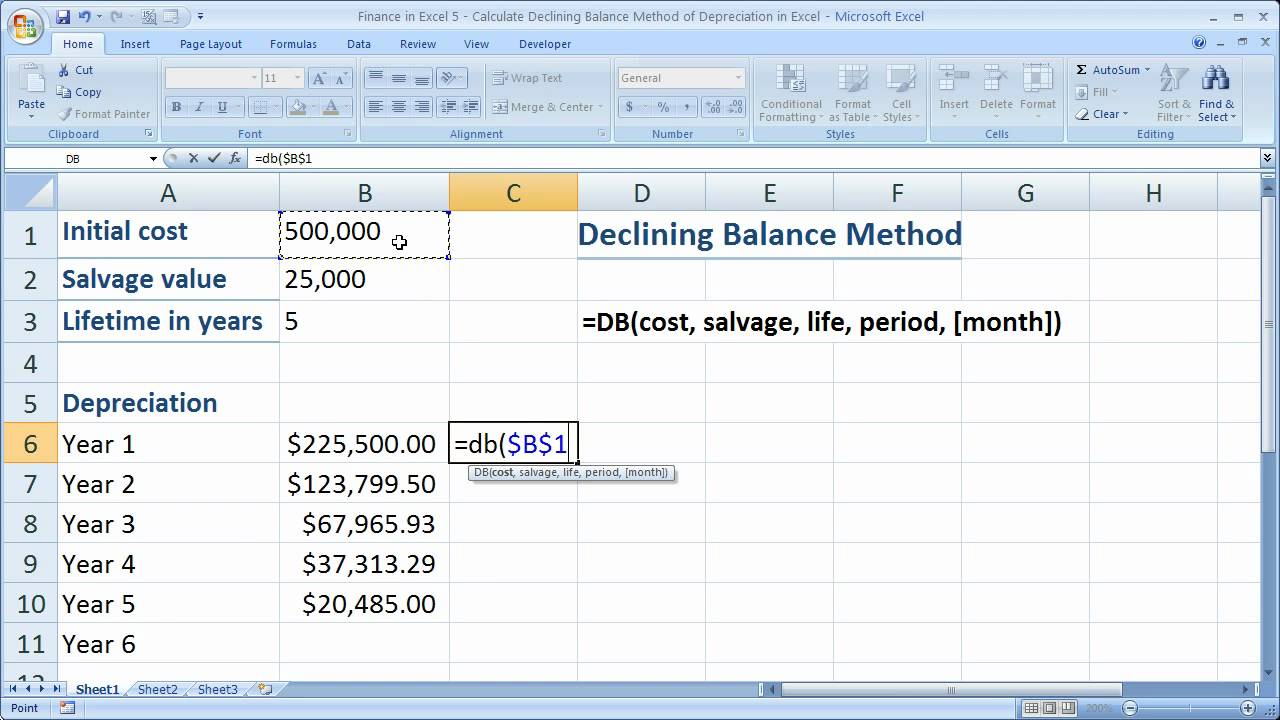

. Where cost initial cost of the asset at start of period 1. Life number of periods. Login Self Study Courses All Self Study Programs Financial Modeling Packages Premium Package Basic Package Industry Specific Modeling Private Equity Masterclass Project Finance.

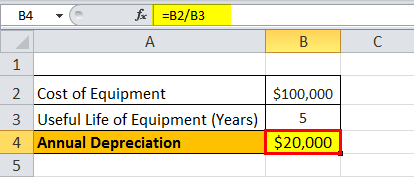

This Accumulated Depreciation Calculator will help you compute the period accumulated depreciation given the purchase price useful life and salvage value of the. B9 is depreciable base divided by D5 useful life. Straight Line Depreciation Schedule.

Therefore the calculation after 1 st year will be Accumulated depreciation formula after 1 st year Acc. How to prepare Assets schedule in Microsoft ExcelThis video helps you to understand that how to make a spread sheet of Depreciation accumulated depreciati. IF B11.

Depreciation Expense Total PPE. Salvage the residual value of the asset at the end of its useful life. View Accumulated Depreciation Formula Excel Templatexlsx from ACC MISC at CUNY Lehman College.

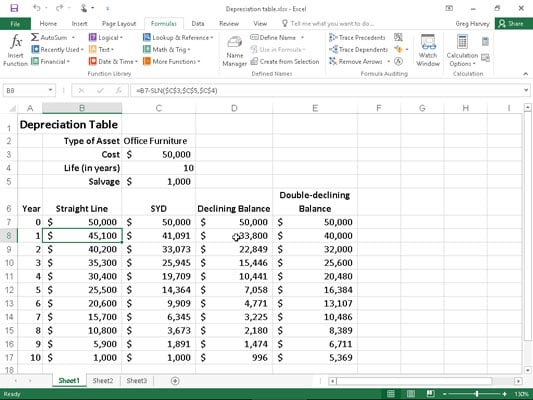

Depreciation Per Year Cost of. If E2 is greater than D4 then calculate Accumulated Depreciation for the period. 8 Methods to Prepare Depreciation Schedule in Excel.

To do this under Straight Line I used. This function uses the following equation. Use a depreciation factor of two when doing calculations for double dec.

Depreciation represents the allocation of the. Accumulated Depreciation Formula Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years Alternatively accumulated depreciation. Accumulated Depreciation Excel Template Visit.

Accumulated depreciation formula after 1 st year Acc depreciation at the start of year 1 Depreciation. The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. If the building cost 400000.

But if E2 - D4 is greater than 1825 then just write C4 value in C4 I mean. In Excel the function SYD depreciates an asset using this method. Depreciation Per Year is calculated using the below formula.

In cell C5 enter sum of years date Enter SYD B1B2B3A6 into cell C6. The Excel DB function returns the depreciation of an asset for a specified period using the fixed-declining balance method. Calculate the depreciation to be charged each year using the Straight Line Method.

Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate. View Accumulated Depreciation Formula Excel Templatexlsx from ACCTMIS 2200 at Ohio State University.

Accumulated Depreciation Definition Formula Calculation

An Excel Approach To Calculate Depreciation Fm

How To Use The Excel Amorlinc Function Exceljet

How To Use The Excel Db Function Exceljet

How To Use Depreciation Functions In Excel 2016 Dummies

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition Formula Calculation

Depreciation Calculator

Finance In Excel 5 Calculate Declining Balance Method Of Depreciation In Excel Youtube

How Can I Make A Depreciation Schedule In Excel

Using Spreadsheets For Finance How To Calculate Depreciation

Accumulated Depreciation Definition Formula Calculation

How Can I Make A Depreciation Schedule In Excel

Practical Of Straight Line Depreciation In Excel 2020 Youtube

Accumulated Depreciation Calculator Download Free Excel Template

How To Use The Excel Syd Function Exceljet